- Executive Resilience Insider

- Posts

- Your best customers are killing you

Your best customers are killing you

Why the customers driving today’s growth are often the source of tomorrow’s churn, margin collapse, and operational drag across the organization.

B2B software investment reaches record levels. Yet market intelligence reveals a brutal paradox: executives optimizing for revenue velocity systematically underperform competitors who focus on customer qualification over aggressive deal closure.

Cross-sector analysis reveals systematic miscalculation:

Organizations perfect sales processes but miss the qualification systems that drive operational efficiency

Revenue leaders chase deal volume as fit-focused competitors build superior unit economics

Executive teams celebrate top-line metrics even as sales debt erodes customer lifetime value

The Sales Debt Paradox:

Revenue velocity ↑ = Customer quality ↓

Deal closure sophistication ↑ = Unit economics deterioration ↑

Top-line growth ↑ = Sustainable positioning ↓

Customer selection generates revenue multipliers faster than volume approaches create market advantages.

Organizations have 90 days to build qualification systems or surrender sustainable growth to competitors who understand that customer fit determines survival in ways sales velocity cannot.

Why revenue-optimized deal-making destroys market positioning

A B2B software startup demonstrated failure patterns now appearing across sectors. Despite achieving unicorn status with over $200 million in funding and billion-dollar valuation, systematic issues threatened long-term survival beneath the surface metrics.

Here's what happened. The company pushed into new international markets. Engineering teams scrambled to build features meeting local requirements. Budgets fragmented, compromising efficiency. Pressure to chase aggressive revenue targets led sales teams to acquire lower-quality customers—accounts more likely to churn, less likely to deliver enough revenue to justify high acquisition costs. The organization drowned under expensive integrations, customizations, and consultants. Core markets languished. A vicious cycle eroded customer lifetime value.

The culprit? Sales debt—the accumulated cost of selling to customers who weren't perfect fits. Short-term revenue came at the expense of long-term growth, relationships, and reputation.

The data tells a brutal story. Fourth-quartile companies now spend $2.82 to acquire every dollar of new annual recurring revenue. Top-quartile performers spend $1.00. This 182% efficiency differential isn't statistical noise. It's systematic advantage that compounds over time.

The revenue growth evolution demonstrates the difference:

Phase 1: Aggressive acquisition producing vanity metrics and fragmented customer bases Phase 2: Sales debt accumulation as poor-fit customers destroy unit economics

Phase 3: Qualification discipline creating sustainable advantages through deliberate selection

Market positioning emerges through customer fit, not deal volume maximization.

The customer qualification methodology that top performers discovered

Market leaders achieving breakthrough results operate through fundamentally different philosophies. They separate revenue generation from customer selection by building comprehensive qualification systems that reveal sustainable opportunities unavailable through traditional sales approaches.

These methodologies eliminate volume dependency. They build advantages through customer assessment that functions regardless of market conditions or pressure to close deals.

The Customer Fit Formula:

Early qualification + Incentive alignment + Unit economics monitoring = Sustainable growth

5 frameworks that transform sales debt into customer selection engines

Framework 1: The Early Filter

How do you stop bad customers before they become expensive mistakes? Build filters during discovery, not after contracts are signed.

Discovery Assessment System

Eric Janssen, CRO of an event tech startup, developed a simple checklist to qualify leads during discovery conversations. Questions about ticketing partners, stage infrastructure, network providers, and security helped identify red flags. Vague answers meant lack of experience and high likelihood of support issues down the line.

"A few months later, the now-infamous Fyre Festival reached out," Janssen explains. "With $25 million in funding and a wave of influencer hype, Fyre looked like a dream client. But during qualification, their answers didn't hold up. Logistical details were vague, infrastructure partners weren't confirmed, and the team sensed something wasn't right. So they walked away."

The festival descended into total chaos and became a global scandal. Saying no spared the team from one of the biggest reputational disasters in recent memory—a company-saving decision enabled by qualification discipline.

The lesson is clear: knowing when to walk away matters as much as knowing when to close.

Empowerment Protocols

Give your sales team permission to say no. Organizations achieving 4:1 to 7:1 lifetime value to acquisition cost ratios consistently filter aggressively during qualification. Bottom-quartile companies accepting poor fits deteriorate toward 2:1 ratios.

Treat no-decisions as wins. Strategic rejection creates advantages that closing pressure alone cannot generate.

But qualification alone isn't enough. If your compensation structure rewards volume over fit, your filters won't matter.

Framework 2: The Incentive Realignment

Sales teams optimize for what gets measured and rewarded. Period.

Compensation Restructuring

An AI startup demonstrated what happens when organizations optimize for revenue rather than customer targeting. The company had developed anomaly-detection software with applications across agriculture, manufacturing, and semiconductors. That breadth impressed investors. But when scaling arrived, everything fell apart. Sales cycles stretched to nine months. R&D was pulled in different directions. Support was overwhelmed.

With 18 months of runway, leadership made a bold move: focus exclusively on semiconductors. They fired all customers outside that segment. Then they rewrote KPIs and sales compensation so only semiconductor customers counted toward quota and commissions.

The result? Shorter sales cycles. Higher win rates. Tighter product-feedback loops. The company quickly regained momentum, secured funding, and was ultimately acquired by Apple.

The takeaway: compensation determines behavior. If you want customer fit, make it count toward quota.

Performance Metrics

Stop rewarding deal velocity alone. Companies achieving sustained growth allocate compensation toward lifetime value metrics, retention performance, and customer quality scores—not just closed deal counts.

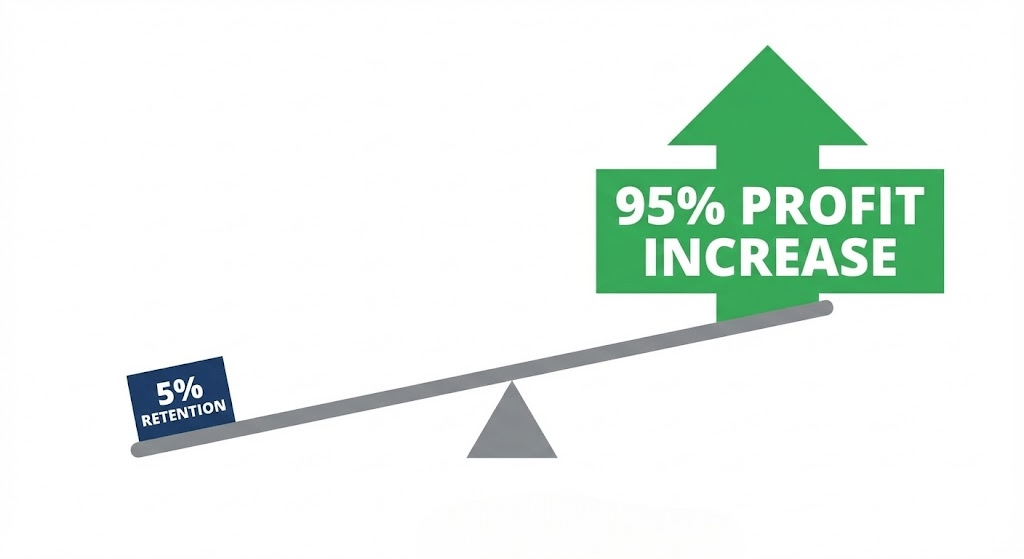

Here's the reality: retention improvements of just 5% increase profitability by 25% to 95%. Yet most sales teams never see compensation tied to these outcomes.

Make fit profitable for your sellers, or expect them to chase every deal that comes through the door.

Here's where most companies fail. They filter well, align incentives, but then treat all customers the same once they're in the door.

Framework 3: The Customer Categorization System

Not all customers deserve equal attention. Controversial? Maybe. True? Absolutely.

Classification Methodology

Smart companies sort their customers into four categories. The GROW framework provides the structure: Gather data from CRM systems, product analytics, support costs, and satisfaction metrics. Review alignment through stakeholder interviews across product, engineering, sales, customer success, and finance teams. Organize customers into categories.

Here's how to think about each segment:

Thriving customers: High value, strong alignment. Your blueprint for growth. Retain them, learn from them, find more like them.

Striving customers: Show promise but need support, new features, or clearer success paths to reach potential.

Transform customers: Misaligned today but offer upside if gaps prove fixable through better onboarding or stronger communication.

Terminate customers: Consume time, distort priorities, create internal tension. Exit gracefully and free your team to serve the right customers.

The hard truth: some customers will never be profitable no matter what you do.

If you're feeling uncomfortable reading this, good. Most executives avoid these conversations because they're hard. But avoiding them costs more than having them.

Action Protocols

Develop resource allocation around account categories rather than uniform treatment. For Thriving accounts, double down through retention investment and pattern replication. For Striving segments, invest selectively in development support. For Transform categories, commit to turnaround plans with defined success metrics. For Terminate accounts, part ways gracefully. Some customers will never achieve profitability despite revenue generation.

HR tech companies demonstrate this pattern. Initially selling to any industry with hourly workers from healthcare to construction to retail. The scattershot approach proved unsustainable with many poor-fit customers. But the informative process revealed franchised restaurants had unique underserved needs for decentralized, mobile-friendly hiring tools. Narrowing focus to this market and building mobile-first products for managers maintained 40% annual growth with greater stability, resulting in successful acquisition within three years.

This is where the data gets interesting. You can have great filters, aligned incentives, and clear categories—but without real-time monitoring, you're flying blind.

Framework 4: The Unit Economics Monitor

Fourth-quartile companies spend $2.82 acquiring each dollar of revenue while top performers spend $1.00. That 182% gap? It's visible in real-time if you're actually watching.

Economic Tracking Protocols

Track three numbers simultaneously:

Customer lifetime value: Account for retention rates, expansion revenue potential, and support cost allocation by segment. Poor-fit customers typically cut lifetime value by 50% or more through elevated churn and excessive service requirements.

Acquisition cost: Include fully-loaded expenses across sales compensation, marketing investment, and operational overhead.

Support cost allocation: Reveals the real operational burden. Poor-fit accounts often require 3 to 10 times higher service costs than ideal customers.

The monitoring tells you what's actually happening, not what you hope is happening.

Dashboard Systems

Build dashboards that track the metrics that matter: LTV:CAC ratios by customer segment, monthly cohort retention patterns, support ticket volume and resolution time by account type, and engineering customization requests.

The thresholds matter: 3:1 or better means healthy unit economics. Between 4:1 and 7:1 indicates excellent results. Falling toward 2:1? You have immediate problems requiring intervention before collapse becomes irreversible.

One more thing. Everything above assumes you should always avoid poor-fit customers. That's not quite right.

Framework 5: The Strategic Learning Approach

Sometimes the wrong customer teaches you something the right customer never could. The key is knowing when to accept that trade-off deliberately.

Intentional Experimentation

An HR tech company began selling broadly to any industry with hourly workers. The scattershot approach wasn't sustainable. Some customers proved poor fits. But here's what they learned: franchised restaurants had unique underserved needs. The company narrowed focus, built mobile-first products for restaurant managers, and maintained 40% annual growth with greater stability. Successful acquisition within three years.

The poor-fit customers weren't mistakes. They were market research.

When funding realities threaten short-term survival, quick revenue from imperfect customers can buy time to fix products, refine messaging, and hire the right teams. Private equity scenarios sometimes demand 18-month revenue maximization windows where deliberate sales debt makes strategic sense.

Strategic debt versus destructive debt? Intent and time limits make all the difference.

Time-Bounded Testing

If you're going to accept poor-fit customers deliberately, set clear learning objectives upfront. Event technology companies demonstrate this well. Landing large corporate clients sometimes reveals complex operational requirements nobody anticipated. Months of compliance protocols, documentation, on-site visits, extensive legal approvals.

These deals take longer than expected. But they force companies to formalize customer success processes, strengthen cross-functional communication, and build repeatable systems for high-stakes engagements.

Don't let these become permanent residents in your customer base.

Choosing customers switches up the revenue game.

Here's the bottom line. Customer qualification requires the same resources as volume approaches. The difference is allocation—toward fit assessment rather than closing sophistication.

Organizations implementing methodical qualification systems consistently outperform deal-velocity-dependent competitors. Volume-focused companies experience account deterioration during scaling periods.

The qualification transformation window narrows. Market leaders discover fit-enabled advantages and establish customer positioning that revenue sophistication cannot replicate.

Companies implementing these qualification systems within the next 90 days establish advantages that volume-dependent executives cannot overcome through sales velocity alone.

Most companies don't starve due to lack of opportunities. They drown due to lack of focus. Sales debt creeps in when teams chase every lead and stretch themselves thin. But when organizations align around clearly defined customer profiles, growth accelerates, satisfaction improves, morale strengthens, and costs decline.