- Executive Resilience Insider

- Posts

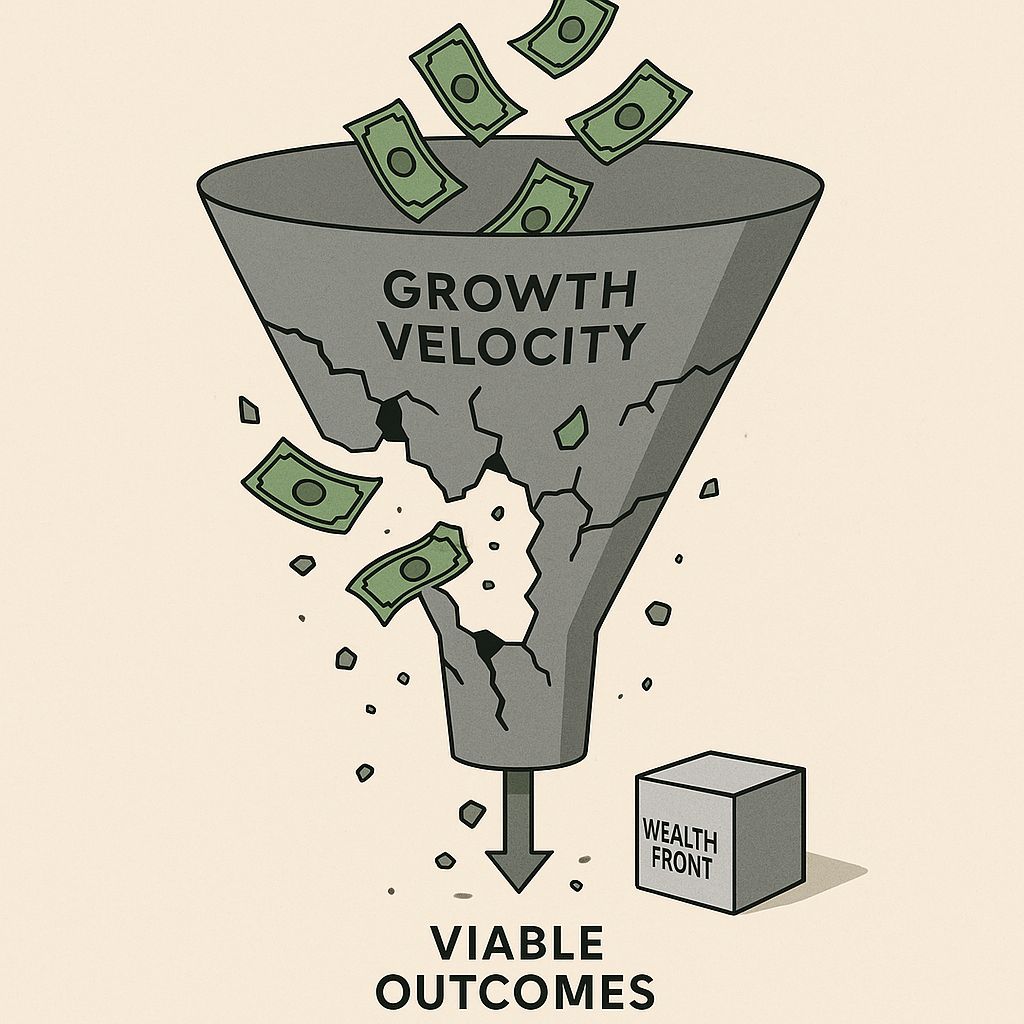

- Why acceleration destroys value

Why acceleration destroys value

The startup world’s speed obsession hides a brutal truth: fast growth kills 95% of viable companies.

An a16z partner's claim hit thousands of retweets last month: "$2M ARR in 10 days is the new normal. Right now, momentum is the only moat." Within hours, founders flooded cap tables celebrating speed metrics while portfolio analysis exposes the brutal paradox this creates: companies optimizing for growth acceleration systematically underperform businesses building profitable operations through unit economics discipline rather than revenue theater.

After analyzing venture portfolios across dozens of high-growth companies, the destruction pattern became impossible to ignore. Organizations prioritizing speed over fundamentals eliminate 95% of viable business outcomes—companies generating $100M-$1B in value that represent actual success. Wealthfront exemplifies the systematic exclusion: 17 years generating $308M revenue and $123M net income. By acceleration standards, this represents failure. By financial reality, this outcome exceeds what 95% of successful businesses achieve.

Investment analyst Kyle Harrison captured the generational destruction: "The louder these types of firms get, the more people keep listening to them. Pretty soon, the ecosystem turns its focus to only wanting to participate in the creation of top 1% outcomes and you lose a generation of middle-class outcomes that generate great results for customers, good jobs for employees, and even make many of them millionaires in the process."

Cross-industry intelligence reveals systematic miscalculation:

Organizations perfecting growth acceleration while profitable competitors capture positioning through unit economics discipline

Leadership teams celebrating fastest-to-$100M charts while financial viability generates advantages that subsidized growth cannot replicate

Executives optimizing for speed metrics while business fundamentals determine survival independent of initial acceleration

The Revenue Quality Paradox:

Growth acceleration ↑ = Profit viability ↓

Speed sophistication ↑ = Unit economics discipline ↓

Velocity celebration ↑ = Financial sustainability ↓

Unit economics frameworks generate survival advantages faster than speed theater creates organizational resilience.

Companies have 90 days to build financial sustainability architectures or surrender positioning to fundamentals-enabled competitors who understand that business viability determines survival, not growth acceleration.

Why acceleration-first cultures destroy financial viability

The speed obsession spreading across industries looks intuitively correct: faster growth must indicate superior execution. After tracking dozens of high-growth companies, the operational reality tells a different story. Acceleration systematically destroys the financial foundations that enable long-term survival.

Bryan Kim's framework exemplifies the failure pattern through systematic confusion between traction and viability. His claim that "$2M in 10 days" should be standard creates toxic operational dynamics. One portfolio company burned through $50M in 18 months chasing this acceleration standard. The mechanics: sales team discounting 60-70% to hit quotas, support drowning under volume they couldn't handle, engineering shipping features nobody wanted just to fill roadmaps for demos, churn spiking to 8% monthly as disappointed customers discovered product didn't match promises.

The revenue looked impressive on announcement. The operations couldn't sustain.

OpenSea demonstrates the pattern at scale. Peak acceleration: $122M monthly revenue supporting $13.3B valuation. The marketplace rode NFT enthusiasm, everyone celebrated fastest-to-unicorn timing. Then market dynamics shifted. Current reality: $365M annualized revenue, massive valuation markdowns. The company isn't necessarily bad—but investors paid for acceleration that couldn't persist because underlying adoption never supported the speed.

Peter Thiel's Zero to One captured what acceleration celebration ignores: "All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition." Speed attracts competition. Competition destroys unit economics. Poor financials eliminate viability regardless of initial acceleration.

The code generation category shows competitive dynamics acceleration creates. Cursor announces $1B ARR through rapid growth. Result: Lovable, Windsurf, Devin, dozens more all racing toward $100M+ ARR. Each burning massive compute costs to Anthropic—one portfolio company's cloud bill hit $400K monthly serving just $150K MRR. Each fighting for customers through sales spending. Each compressing pricing to compete. Category financials deteriorate for everyone as competition intensifies driven by announced speed.

Market advantage accrues to companies that invert acceleration obsession—building profitable operations over growth theater.

The profitability methodology that outperforming companies use

Market leaders achieving breakthrough results operate through fundamentally different growth philosophies. After analyzing performance across portfolios, the distinction became clear: sustainable businesses optimize for customer profit contribution exceeding acquisition cost within acceptable payback periods. Speed-focused organizations optimize for hitting ARR milestones regardless of underlying financials—selling $2 for $1, subsidizing usage to inflate metrics, counting free trials as revenue then annualizing projections.

Harrison's portfolio analysis demonstrates systematic patterns: "To build a company that goes from $1M to $20M to $100M, you likely have to be MUCH more aggressive on pricing, marketing, hiring, R&D. Basically every facet of the business has to be supercharged. Outside of the small subset of outliers that can see massive scale with a couple of employees, the majority of companies have to build in unsustainable ways to achieve that kind of scale."

Wealthfront's trajectory demonstrates financial discipline advantages. Seventeen years building toward $308M revenue and $123M net income represents "middle-class" outcome by venture standards. But this viability enables: employment for hundreds, wealth creation for employees, service value for customers, operational independence from capital markets. The company survives and thrives regardless of funding environment changes because operations generate actual profit.

Companies building profitable operations outperform speed-optimized competitors during market contractions. When capital becomes expensive or unavailable, acceleration-dependent businesses collapse. Economically disciplined organizations continue operating because fundamentals work independent of external funding.

Here's the mechanism:

Unit economics discipline + Profitable customer acquisition + Operations generating cash = Market independence

Organizations implementing financial viability consistently outperform businesses dependent on speed validation.

4 systems that transform velocity theater into economic advantage engines

System 1: The Unit Economics Reality Engine

Speed metrics hide financial dysfunction. Profitable businesses implement transparent cohort analysis at every revenue level.

The Profitability Protocol

Most operational dysfunction during market shifts traces to financial confusion masquerading as growth. The acceleration framework assumes revenue quality doesn't matter if speed impresses investors. Reality requires explicit evaluation: does each customer generate more value than acquisition and service costs within acceptable timeframes?

One SaaS company hit $10M ARR in 18 months, celebrated across industry publications. Behind the announcement: 200% net revenue retention sounded impressive until analysis revealed it came from 300% expansion in top 10 accounts while remaining 200+ customers churned at 40% annually. Aggregate metric looked strong. Cohort analysis revealed disaster—only enterprise segment worked, SMB bleeding cash with $8K acquisition cost for customers generating $3K lifetime value.

The critical distinction separates viable revenue from subsidized theater. A company hitting $10M ARR at 120% retention with 12-month payback builds real business. A competitor hitting $10M through massive discounting with 48-month payback creates announcement material that collapses when growth slows or capital tightens.

Effective financial discipline tracks cohort profitability rather than aggregate metrics. When someone celebrates "$100M ARR in 18 months," first question shouldn't be "how fast?" but "what does customer-level financial performance look like?"

Implementation Architecture

Weekly cohort analysis tracking customer acquisition cost, lifetime value, payback period by segment. No celebrations for revenue milestones until unit economics validate viability.

Monthly financial reviews separate growth investments (negative short-term performance, strategic long-term value) from unsustainable bleeding (poor financials with no path to profitability). The distinction determines whether aggressive spending builds foundation or creates theater.

Quarterly forecasting projects profit trajectory under various growth scenarios. Model: "If we grow 50% next year, when do we reach profitability? If we grow 20%, how does timeline change?" This reveals whether acceleration is requirement or choice.

System 2: The Competitive Moat Constructor

Speed attracts competition. Competition destroys unit economics. Profitable businesses build defensibility through differentiation rather than announcing acceleration that floods markets with copycats.

The Anti-Theater Strategy

Investment analyst Packy McCormick identified the acceleration paradox: announcing fast growth attracts competitive flood that destroys financials for everyone. "Momentum is actually an anti-moat."

The pattern repeats across categories. Company announces impressive speed in attractive market. Competitors immediately flood category racing toward same metrics. Each new entrant makes customer acquisition more expensive, retention more difficult, pricing more compressed.

Code generation demonstrates competitive dynamics perfectly. After analyzing the category: Cursor's $1B ARR announcement triggered dozens of competitors. One emerging player's cloud infrastructure bill hit $400K monthly serving $150K MRR—burning $3 for every $1 generated. Another company raised $50M but discovered six competitors launched within 90 days, each fighting for same enterprise accounts. Customer acquisition cost exploded from $8K to $25K in six months as competition intensified. What started as attractive unit economics became unsustainable for everyone.

Venture partner Hemant Taneja exemplifies the systematic exclusion velocity thinking creates: "Triple, triple, double, double, double is dead. You need to go from $1M to $20M to $100M to be interesting." This represents perspective managing multi-billion dollar funds. It poisons ecosystem for everyone else.

Reality: less than 5% of public companies exceed $10B valuation. Less than 1% exceed $100B. When entire ecosystem optimizes only for decacorn outcomes, 95% of viable businesses get excluded despite generating substantial value. Wealthfront's $308M revenue with $123M profit would be excluded by this thinking despite representing outcome most successful businesses would celebrate.

Traditional moat construction—switching costs, network effects, economies of scale, proprietary data—requires time and discipline to build. Speed celebration provides none of these. Instead, it signals "attractive market" which attracts competitive intensity preventing moat construction.

Implementation Mechanics

Competitive analysis tracking market entrant acceleration versus financial deterioration. When new competitors flood category, that signals theater rather than defensible business.

Differentiation investment separate from growth spending. Allocate resources toward unique capabilities: proprietary technology, customer switching costs, network effects, operational excellence.

Quiet building over loud announcing. Minimize public celebration of speed metrics attracting competitive attention. Maximize internal focus on financial viability and differentiation competitors cannot easily replicate.

System 3: The Innovation Engine vs. Traction Theater Separator

Elon Musk advocates innovation pace over static moats. Speed investors confuse this with traction acceleration. The distinction determines whether fast growth indicates strong capability or theater.

Quality Engine Development

Musk's assertion that "moats are lame" and "what matters is the pace of innovation" gets misinterpreted as validation for acceleration obsession. But innovation pace means capability for rapid iteration, quality improvement, and efficiency gains—not just fast revenue growth.

Alex Immerman, an a16z partner, corrected the acceleration framework: "Momentum isn't the moat; it's the boat. It is what gets you to the island where you can build a fortress."

The critical distinction separates innovation capability from traction theater. Some companies achieve high acceleration through sub-par products on unsustainable models. One portfolio company hit $5M ARR in 8 months through aggressive discounting—60% off list price to enterprise accounts, free pilots converted to "revenue" in projections. Product NPS score: 12. Churn: 45% annually. They generated ARR growth but lacked capability for continued innovation, quality improvement, or efficiency gains.

Other companies achieve growth through genuine capability—superior product quality, step-function improvements, operational excellence. They become more efficient over time, serve customers better as they learn, ship higher quality with each release.

The worst outcome: massive capital obscures the difference. When companies raise huge rounds based on acceleration theater, that capital allows them to continue unsustainable practices while appearing successful. They attract talent, generate press, raise more funding—all lacking fundamental innovation capability.

Protocol Implementation

Innovation assessment separate from traction assessment. Evaluate: product quality improvements over time, operational efficiency gains, team capability development, customer satisfaction trends independent of growth.

Capital efficiency analysis revealing whether growth requires increasing or decreasing capital intensity. Strong innovation capability becomes more efficient over time. Theater requires escalating capital to maintain acceleration.

Cohort comparison showing whether customer value increases over time. Strong capability serves customers better as companies learn. Theater shows degrading satisfaction as unsustainable practices catch up.

Financial discipline beats speed theater

Building profitable businesses requires equivalent resources as acceleration optimization—just allocated toward unit economics instead of growth announcements.

After analyzing dozens of high-growth companies, the pattern became undeniable. The speed obsession spreading across industries celebrates outcomes less than 5% of successful companies achieve. Organizations optimizing exclusively for fastest-to-$100M eliminate 95% of viable businesses generating substantial value through financial discipline.

Wealthfront's trajectory—$308M revenue, $123M profit after 17 years—represents exactly what most successful businesses achieve. By acceleration standards: irrelevant. By financial reality: substantial value creation that 95% of companies would celebrate.

OpenSea's correction demonstrates acceleration risk. Peak speed: $122M monthly revenue supporting $13.3B valuation. Current reality: $365M annualized revenue with massive markdowns. Investors paid for acceleration that couldn't persist because underlying adoption never supported the speed.

The competitive dynamics compound destruction. Code generation shows the pattern: after Cursor's announcement, dozens of competitors burning $400K monthly cloud bills serving $150K MRR. Each fighting for same customers. Category financials deteriorate for everyone.

Harrison captured the generational impact: "That extends itself into influencing the next generation of companies. Then everyone is building with the same playbooks of unproven models, unsustainable economics, sub-par growth engines."

The correction requires explicit financial discipline over acceleration celebration. Track unit economics transparently. Celebrate profitability milestones over growth theater. Build competitive moats through differentiation rather than announcing speed. Develop innovation capability versus traction theater.

Market leaders are discovering financially-enabled advantages. Speed-obsessed competitors discover their foundations cannot persist. The transformation window narrows as profitable businesses implement discipline architectures.

Companies building these systems within 90 days establish advantages that acceleration-dependent organizations cannot overcome through speed optimization lacking financial foundation.

The choice determines survival. The window closes. The consequences compound.